If someone has ever been fascinated by swift moves in the market—neither blink-and-you-miss-it fast nor sleep-through-it slow—they are likely looking for that sweet spot between extremes. Welcome to the world of swing trading, where opportunities emerge from the very movement of the market itself. Navigating this field takes more than luck or intuition; it begins with an understanding of how prices actually move, what shapes decisions, and, of course, how to guard against the unexpected.

Understanding swing trading: The middle path

Swing trading means holding positions for days or weeks, seeking to profit from expected price swings that are larger than day-to-day noise but not quite the marathon of long-term investing. Where day traders buy and sell within hours (sometimes minutes) and long-term investors may hold for years, swing traders focus on the in-between—moves that might play out over three to ten days, or perhaps two to six weeks.

Patience, but with a deadline. That’s the swing trader’s mindset.

Dr Tiago, lead mentor at the Institutional Trading Academy, regularly explains that the core distinction comes down to time horizon and approach. Unlike day trading, there’s no staring at screens all day; nor is there the passivity or reliance on fundamentals that characterizes longer investing. It’s proactive, purposeful, and built on understanding patterns in price behavior as they unfold over a manageable window.

Studies such as analysis by the U.S. Securities and Exchange Commission highlight how different investor time frames influence risk-taking, reaction to losses, and emotional discipline—core issues for anyone learning to swing trade.

How price action and technical analysis drive decisions

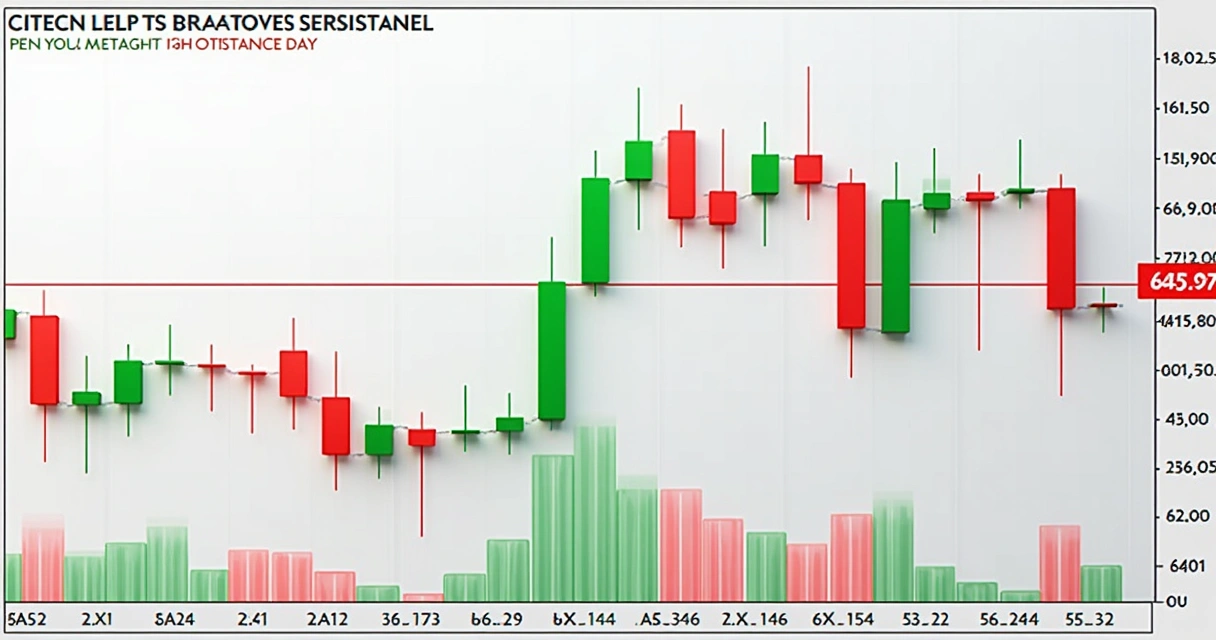

Why do some charts feel so alive? Every swing trader, before even thinking about making that first real or simulated trade, must build a relationship with price charts and indicators. The secret sauce? Technical analysis.

Technical analysis is the study of price and volume to find repeatable, actionable patterns. Unlike fundamental analysis, which looks at company earnings or macroeconomic data, technical analysis focuses on what the market itself is revealing—crowd psychology made visible through bars, candles or lines.

A peer-reviewed study examining technical trading rules in Southeast Asian stock markets demonstrates that indicators like moving averages and momentum strategies can actually produce measurable profits in some situations.

- Price tells the story. Every up or down move reflects a shift in balance between buyers and sellers.

- Volume signals conviction. Is a breakout real? High volume makes it more believable.

- Indicators act as a guide. They reduce noise, providing potential signal about direction or risk.

Essential tools: Charts, candles, and context

Swing traders typically use candlestick charts, which provide much more information than simple lines or bars. Each candle compresses open, high, low, and close into one tiny snapshot—making it easier to spot trends, reversals, and momentum at a glance.

Context matters. An uptrend after a long period of trading sideways may signal a genuine shift more than a one-off rally. Dr Tiago sometimes compares spotting these potential moves to reading the crowd before a big announcement; subtle hints often lead to significant movement.

Key strategies: Finding the edge

Now, strategies don’t have to be complicated to be effective. The two most practiced approaches in the Institutional Trading Academy community involve trading breakouts and riding trends. Both aim to capitalize on clear, recognizable moves in the market, but in slightly different ways.

Breakout trading: Surfing the wave

Breakout trading: Surfing the wave

Breakout trading means entering a trade when the price pushes beyond a well-defined support or resistance level, often followed by heavier volume.

- Identify a price “ceiling” (resistance) or “floor” (support) on the chart.

- Watch as price approaches these zones, often with decreasing volatility—like gathering energy.

- When price shoots through, the move can be quick and significant, as new participants rush in.

An example: Imagine a stock nudging up against $100 for days, falling back, then pushing up again. Suddenly, with higher volume, it breaks above $100 and quickly rises to $105 or $107, sometimes even higher before stalling out. The best trades come on convincing breakouts, confirmed by strong volume—the “crowd” is joining in.

Trend following: Riding the current

Instead of waiting for a breakout, trend-following swing traders look to join established uptrends or downtrends, surviving small corrections but sticking with the broader move.

This might sound deceptively simple: Buy when the market is rising, sell (or short) when it’s falling. But it’s more nuanced in practice. A swing trader must decide if the trend is strong enough, or if they’re buying into exhaustion.

- Trend traders use moving averages (often the 20-, 50-, or 200-period) to define direction.

- As long as price remains above the chosen average, entries are considered valid. A close below could signal exit.

A classic real-world story: In 2021, tech stocks showed pronounced directional runs. Traders using the 21-day exponential moving average waited for pullbacks near this line, then entered trades when price rebounded. Stops were placed just below the average, protecting against abrupt reversals.

Indicators: The swing trader’s toolkit

Deciding exactly when to get in and out comes from blending several tools. Institutional Trading Academy mentors teach a set of indicators that work together, each with their unique message.

- Moving averages: Smooth out price data and highlight direction. Crossovers (when short-term averages cross above or below longer-term ones) often trigger trades.

- Relative Strength Index (RSI): Measures momentum and the speed of price moves. Readings above 70 often mean “overbought,” and below 30 “oversold.”

- Support and resistance zones: Visually drawn lines where previous reversals took place. They show where buyers or sellers have consistently reacted.

A good entry isn’t just about price. It’s about context, confirmation, and discipline.

For more depth on effective indicator application, the book ‘Swing Trading: Power Strategies to Cut Risk and Boost Profits’ by Jon D. Markman covers these methods for those seeking a comprehensive resource—and those who thrive on practical details.

For more depth on effective indicator application, the book ‘Swing Trading: Power Strategies to Cut Risk and Boost Profits’ by Jon D. Markman covers these methods for those seeking a comprehensive resource—and those who thrive on practical details.

Risk management: Protecting capital above all

Good swing trading is as much about survival as winning. The fastest route to blowing up an account is neglecting risk management. Many new traders focus too much on finding “the” trade and not enough on how much is at risk per trade—or what happens when things go sideways.

Position sizing and stop-losses

Position sizing simply means adjusting how much to buy based on the distance between entry and stop-loss. The further away a stop is, the smaller the position should be. Common advice is to risk only 1–2% of account equity per trade.

A stop-loss is a pre-determined exit point, set to cap losses if a trade turns sour. These can be set just beyond major support/resistance, or at a level where the original trade thesis is no longer valid. Using stop-losses faithfully is what keeps a string of small losses from becoming a disaster.

- Calculate risk per trade: Account equity × maximum risk % per trade = $ risked.

- Figure stop-loss distance: Entry price minus stop-loss price (or vice versa for shorts).

- Divide $ risked by stop-loss distance to get position size.

Common mistakes and pitfalls

- Trading too large for the account size. Greed and impatience are tempting but costly.

- Moving stop-losses further away “just this once.” Discipline means never breaking your own rule.

- Entering trades without a plan. Hope is not a valid strategy.

According to research from Stanford’s Institute for Economic Policy Research, active participation in trading (with careful risk control) increases confidence, knowledge, and future self-reliance—further reason to start small and learn by doing.

Real-world example: Connecting strategy to outcome

Real-world example: Connecting strategy to outcome

Imagine Ana, a trader in the Institutional Trading Academy funded program, notices a stock consolidating under a clear resistance at $50. On Monday, she sees a breakout above that level, with double average volume and a strong bullish candle. She enters a trade at $50.25, sets a stop at $48.75 (risk of $1.50) and targets $54 for her exit, using a recent swing high.

Her account size is $10,000. Risking 1% per trade, her position size is approximately 67 shares [(10,000 × 0.01) / 1.50]. The move hits $54 a few days later, and she closes for a $250 profit. If the trade had reversed, her loss would have been limited by the stop.

Measured steps. Repeatable process. That is risk-managed swing trading.

Making it a habit: Mindset and routine

Someone who succeeds in this style rarely does so by accident. Trading is both skill and habit, and routines make all the difference. The Institutional Trading Academy emphasizes building checklists, reviewing trades, and regular self-reflection. They suggest tracking not only wins and losses, but how well rules were followed.

- Set aside regular review time for market analysis and improvement.

- Use simulator accounts if possible, especially for beginners, to develop consistency before risking real money.

- Don’t trade out of boredom. More trades mean more mistakes, especially if there is no clear plan.

A resource for deepening knowledge about trading routines, self-reflection, and improvement can be found at the Institutional Trading Academy’s FAQ section, which covers common questions and real-life case studies from their experienced mentor team.

Conclusion: Building a swing trading future

Swing trading offers that flexible path between hyperactive speculation and slow-burn investing. With a solid grounding in charts, proven strategies, and, above all, risk management, it becomes not just a technique but a professional discipline. Projects like Institutional Trading Academy strive to make this path accessible, supportive, and open to all backgrounds—providing capital, knowledge, and community.

Those ready to start their journey can find resources, mentorship, and real-world challenges with the different account opportunities available. Active participants, like those seen at Institutional Trading Academy’s blog, often partner or join as affiliates through their affiliate program.

Swing trading may seem complex at first, but step-by-step practice and community make it possible to not only understand but thrive. Consider making your first move—start with a simulated account or join a community like the Institutional Trading Academy. The next swing could be yours.

Frequently asked questions

What is swing trading in stocks?

Swing trading in stocks is a strategy where traders hold positions for several days to a few weeks, aiming to capture shorter-term price moves based on technical analysis and chart patterns rather than company fundamentals or daily fluctuations. The strategy sits between day trading’s rapid in-and-out activity and the longer holding period of investors.

How do I start swing trading?

To start, it’s wise to gain a solid understanding of price charts, key indicators (like moving averages and RSI), and set up a trading plan that defines entries, exits, and risk controls. Many new traders learn by using demo or simulated accounts or by joining communities that offer structured challenges. Materials such as books and training from established academies also help.

What are common swing trading risks?

The greatest risks include sudden market reversals, holding positions through unexpected news, overtrading, and neglecting proper position sizing or stop-loss setting. Some traders lose by letting hope override their rules. Limiting risk per trade and maintaining discipline are the most effective guards against these outcomes.

Is swing trading profitable for beginners?

Swing trading can be profitable for beginners who start slowly, follow clear rules, and use risk management from the beginning. The learning curve is steep but manageable, especially with support from educational communities like Institutional Trading Academy and practice through simulations. Success usually comes from consistency and patience, not quick wins.

What are top swing trading strategies?

Popular and effective swing trading strategies include breakout trades (entering as price moves beyond key support or resistance), pullback entries in established trends, and momentum-based trades confirmed by high volume and strong price movement. Each approach blends technical indicators, price action, and strict risk controls for best results.